Mobile Ad Monetization and the Evolution of Mediation Platforms

Publishers play a key role in mobile advertising. This article looks at how ad monetization has evolved over time and why mediation platforms are now essential for maximizing ad revenue.

In-app advertising has become a staple of our mobile experience, offering a way for users to enjoy apps and games for free while allowing developers to generate revenue to maintain or create new projects. But how did mobile advertising reach this point? What role do mediation platforms play, and how do they work? In this article, we’ll break down the evolution of mobile advertising, uncover the mechanics of mediation platforms, and explore their impact on app monetization.

The Evolution of Mobile Advertising

In 2006, the mobile phone market was highly fragmented, with no standardized way for users to discover or download apps. Most apps were downloaded directly from websites, many of which were unreliable and posed significant security risks, such as malware. Some mobile carriers offered app portals, but these were rudimentary and provided a limited selection of apps.

The launch of the Apple App Store on July 10, 2008, marked a transformative moment for mobile advertising. With 500 apps at launch, the App Store rapidly grew in popularity, reaching over 65,000 apps by 2009. Google soon followed with the Google Play Store in 2009, debuting with 16,000 apps. These centralized, secure marketplaces revolutionized app discovery and created an entirely new ecosystem for developers and advertisers.

However, the explosion of apps introduced a significant challenge: discoverability. With app stores hosting hundreds of thousands of apps, users struggled to find relevant apps. To address this, Apple introduced a featuring team to curate and promote select apps. While effective, this approach was controversial, with reports of developers resorting to extreme measures, including bribes, to secure a coveted featured spot.

The discoverability problem spurred the rise of in-app advertising. Developers began using in-app ads to improve visibility and generate revenue. AdMob, credited with running the first in-app ad in 2006, pioneered this strategy, laying the foundation for a new era in mobile advertising.

As mobile advertising matured, ad networks became essential intermediaries connecting advertisers and publishers. However, publishers soon realized that relying on a single ad network limited their revenue potential. This realization led to the development of mobile ad mediation platforms, which allowed publishers to integrate and manage multiple ad networks through a single interface. These platforms optimized ad revenue by dynamically allocating ad space to the highest bidder.

Google’s $750 million acquisition of AdMob in 2009 solidified its leadership in the mobile advertising industry. Today, paid ads delivered through mediation platforms drive an estimated 40% to 50% of all app downloads, underscoring the profound impact of mobile advertising on the broader ecosystem.

The Rise of Mediation Platforms

The rapid growth of mobile advertising gave rise to a new challenge: How could publishers effectively manage and optimize their ad revenue streams in an increasingly complex marketplace?

App discoverability challenges and the rise of in-app advertising further complicated the landscape. As the number of ad networks multiplied, publishers struggled to connect with and manage multiple networks while ensuring competitive pricing for their ad inventory.

This is where mobile ad mediation platforms came in. Mediation platforms emerged as a solution by providing publishers with a centralized platform to connect to and manage multiple ad networks. This streamlined the process of selling ad inventory and allowed publishers to

Increased competition for ad inventory: By connecting to multiple ad networks, mediation platforms fostered a competitive bidding environment, driving up ad prices and maximizing revenue. A publisher leveraging mediation could see higher returns compared to relying on a single network.

Improved fill rates: Mediation platforms dynamically allocated ad space to the highest bidder, ensuring consistent ad request fulfillment and boosting revenue through increased impressions.

Streamlined operations: By consolidating multiple SDKs and network relationships into a single platform, mediation platforms drastically reduced manual management and technical overhead.

The evolution of mediation platforms has paralleled the growth of mobile advertising. Early platforms prioritized network integration, but as the industry matured, they introduced advanced features to meet the growing demands of publishers:

Sophisticated optimization algorithms that use machine learning to allocate inventory to the highest-paying networks automatically.

Comprehensive analytics that provide actionable insights into ad performance, user behavior, and revenue trends.

Tools for A/B testing and creative management to refine advertising strategies.

Cross-promotion and user acquisition tools to drive app growth and retention.

Today, leading mediation platforms like Google’s AdMob, Unity’s LevelPlay, and AppLovin’s MAX dominate the market. Each of them has their pros and cons:

How App Mediation Works

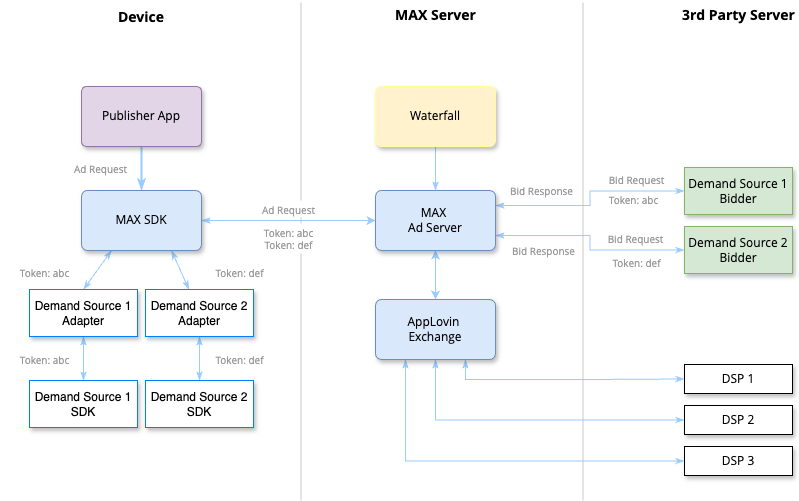

Using AppLovin’s MAX as an example, here’s a step-by-step breakdown of how ad serving works, according to their document:

App Launch: The user opens the app.

SDK Initialization: MAX initializes all eligible ad network SDKs.

Ad Request: The publisher requests an ad from MAX.

Bid Collection: For SDK bidders, MAX collects bid tokens from initialized SDKs.

Ad Server Request: MAX SDK sends an ad request to the MAX ad server.

Auction Process: The MAX auction server collects bids from SDK bidders and DSPs via the AppLovin Exchange, passing identity tokens in the bid requests.

Bid Return: Real-time bids from DSPs and SDK bidders are returned within a set timeout (tmax) and merged with non-bidding demand sources in the publisher’s waterfall.

Auction Resolution: MAX determines the winning bid based on the highest CPM value.

Loss Notifications: MAX notifies losing bidders if their bids fail due to errors, invalid values, or not meeting the minimum bid floor.

Ad Display:

If the winner is a DSP, MAX notifies the DSP, and the AppLovin SDK loads and shows the ad.

If the winner is an SDK bidder, MAX notifies the winning bidder’s SDK to load and display the ad.

Outcome Notifications:

If the ad loads successfully, MAX sends a win notification to the bidder.

If it fails, MAX sends a loss notification.

Billing: After the ad renders, MAX calls the winner’s billing URL.

Many publishers use a hybrid monetization model, combining mediation waterfall and first-price auction open exchange. This approach balances revenue maximization with risk management and cash flow predictability. For example, an SSP (Supply-Side Platform) may offer a minimum spend guarantee in exchange for top placement in the waterfall. This ensures publishers receive guaranteed revenue, even if open exchange CPMs are lower.

Benefits of a Hybrid Model:

Maximized Revenue: Leverage both waterfall and open exchange bidding for optimal results.

Risk Mitigation: Secure minimum spend guarantees to reduce revenue volatility.

Predictable Cash Flow: Maintain consistent earnings with guaranteed deals.

To optimize their ad revenue, publishers should adopt the following practices:

Integrate Ads Early in Game Design: Ads should be considered from the start to create a seamless user experience. For example, rewarded ads can incentivize users to engage with game mechanics and enhance user lifetime value.

Test SDK Quality: Not all SDKs are created equal—low-quality SDKs can introduce technical issues that harm user experience and revenue potential.

Diversify Ad Formats: Experiment with different ad types, such as rewarded videos, interstitials, and offer walls, to monetize effectively.

How Ad Revenue is Calculated

Two factors determine a publisher's ad revenue:

eCPM: This represents the effective cost per thousand impressions. Essentially, it's the price a publisher receives for every 1,000 ad impressions displayed within their app.

Fill Rate: This is the percentage of times an ad request is successfully filled by an ad network.

Ad Revenue = eCPM x Fill Rate

Therefore, even if an app has a high eCPM, if the fill rate is low, the overall ad revenue will be limited. Conversely, a moderate eCPM with a high fill rate can generate significant ad revenue. Publishers should aim to optimize both eCPM and fill rate to maximize their earnings.

eCPM is influenced by a multitude of factors, many of which are determined by complex algorithms used by ad networks. These algorithms take into account factors such as:

Number of Unique Viewers: The more unique users an app has, the more valuable its ad inventory becomes, leading to higher eCPMs.

Click-Through Rate (CTR): A high CTR indicates that users are engaging with the ads, which makes the ad inventory more appealing to advertisers and drives up eCPMs.

Install Rate: The percentage of users who install the advertised app after clicking on an ad is a crucial metric. A higher install rate signifies high-quality traffic, attracting advertisers willing to pay higher eCPMs.

Competition: The number of ad networks bidding on ad inventory impacts eCPM. Increased competition typically leads to higher bids, pushing eCPMs upward.

Geolocation: Users in regions with higher spending power, such as the United States, tend to generate higher eCPMs compared to users in other regions. Advertisers are willing to pay a premium to reach these audiences.

Recency Effect: Ad networks factor in how many ads a user has already seen. They assume users pay more attention to initial impressions, leading to a decline in eCPMs as a user sees more ads within a given timeframe.

eCPM is a dynamic metric influenced by the complex algorithms employed by ad networks. These algorithms consider numerous factors, including user behavior, app demographics, and market trends. Publishers need to understand these factors to optimize their eCPMs and maximize their ad revenue.

How much can publishers expect to earn?

Rewarded Video Ads:

U.S.: $10–$30 per eCPM.

Non-U.S.: $5 or less per eCPM.

Interstitial Ads:

U.S.: $1.6–$15 per eCPM (varies slightly between iOS and Android).

Non-U.S.: Data unspecified, but generally lower than U.S. payouts.

Best Practices for Ad Monetization in Different Phases

Soft Launch or Early Development

During the early stages, publishers should prioritize maximizing ad impressions over eCPM. The goal is to ensure users see 5–10 ad impressions per day, focusing on rewarded and interstitial ads to build a sustainable ad revenue stream.

If app revenue is split 70% in-app purchases (IAP) / 30% ad revenue, aim for:

Ad Viewer Rate: 50–60% of users should view ads.

Daily Ad Views Per User:

Rewarded Ads: 5–7 impressions daily.

Interstitial Ads: 2–7 impressions daily.

These numbers should align with a 30-day retention curve, ensuring consistent engagement.

Scaling Phase

Once an app scales to $2,000–$15,000 in daily ad revenue, publishers should focus on working with 6–10 ad networks via mediation platforms. This phase requires strategic optimization of networks:

Start with High-Performing Networks: Use tools like AppsFlyer’s Performance Index to identify top networks in the region.

Selected Networks by Format:

Banner Ads: Google, Meta, Appier, AppLovin, Unity, Digital Turbine, inMobi.

Interstitial Ads: Google, Meta, Appier, AppLovin, Unity, Digital Turbine, Liftoff, IronSource, Mintegral.

Rewarded Ads: Google, Meta, Appier, AppLovin, Unity, Digital Turbine, Liftoff, IronSource, Mintegral.

Prioritize Networks Contributing ≥5% Revenue: Regularly review ad network performance. Replace underperforming networks generating less than 5% of total revenue with stronger alternatives to maximize earnings.

By combining robust ad mediation, a diversified network strategy, and continuous optimization, publishers can achieve sustainable and scalable ad revenue growth.

Summary

Mobile advertising has undergone a remarkable transformation, evolving from fragmented app portals to robust ecosystems driven by mediation platforms and dynamic revenue models. Today, mediation platforms like AdMob, LevelPlay, and MAX empower publishers to optimize their ad revenue through sophisticated bidding processes, hybrid monetization strategies, and advanced analytics. By leveraging best practices such as early ad integration, diversified ad formats, and data-driven network management, publishers can unlock sustainable revenue streams while enhancing user experiences. The future of mobile advertising lies in continuous innovation, balancing profitability with seamless, user-first design.